Us bank equity line of credit calculator

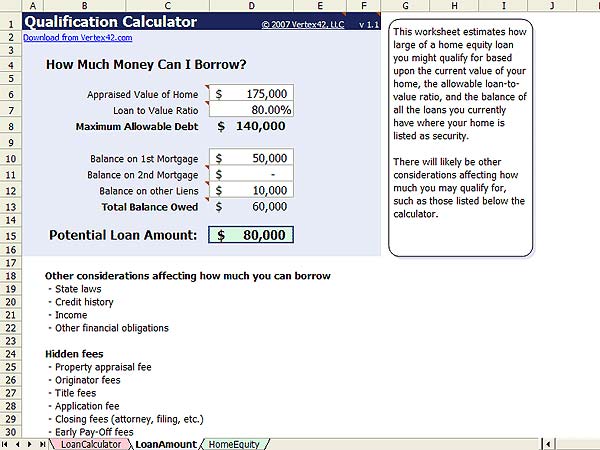

Use this calculator to determine the home equity line of credit amount you may qualify to receive. Home equity loan and HELOC guide.

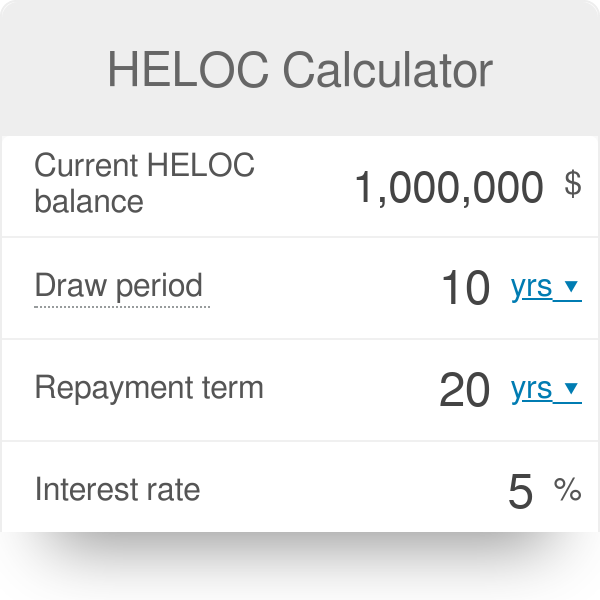

Heloc Calculator

Affordable annual fee.

. Money will be advanced to you up to your credit limit Ameris Bank will pay your closing costsup to 2000 1. Since a home equity line of credit may have a longer term than some of the bills being consolidated there may not be a savings over the entire time of the line if you make only the minimum payments. As of Prime Rate is.

In that way its a little like a credit card except with a HELOC your home is used as collateral. You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only. With a Home Equity Line of Credit you will choose if you want to make Interest-Only or Principal and Interest payments during the 10-year Draw Period when you have access to your line of credit up to your available credit limit.

This election of Interest-Only or Principal and Interest payments may be changed every 12 months. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. All home equity calculators.

Unlike a conventional loan a home equity line of credit is something you establish ahead of time and use when and if you need it. A Home Equity Line of Credit is a revolving line of credit. What is a HELOC.

Youre given a line of credit thats available for a set time frame usually up to 10 years. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible.

Federally Guaranteed Student Loans and other loans with special government benefits should not be consolidated because you may lose the benefits. Use the equity youve built to get a competitive-rate home equity line of credit HELOC. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

Contact us online Home Equity Credit Line Fixed 12 month introductory period. Minimum line amount for Prime is 200000. This means that as you pay off the credit advanced to you you can use the credit line again throughout the term of your agreement.

The interest rate is fixed for the life of the loan. Whether youre funding home renovations sending a child to college or helping pay for a wedding well work alongside you to find a lending option that works best. Using the equity youve built in your home we can provide you with a revolving line of credit to help you finance important purchases or consolidate high-interest debt.

To 5 pm ET to get answers to your questions. Our maximum loan amounts and available equity requirements vary by property type. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line.

Line of credit calculator. A HELOC is a line of credit borrowed against the available equity of your home. 1st or 2nd mortgages over 7500 up to 300000.

Other rates are available for lines of credit in amounts below 200000. The more your home is worth the larger the line of credit. What is a home equity loan.

A Trustco home equity loan or line of credit allows you to borrow the money you need for home improvements a new car the boat youve always wanted and so many other important purchases. A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. For lines of credit up to 500000 we will lend up to 85 of the total equity in your home for a new HELOC secured by a first or second lien.

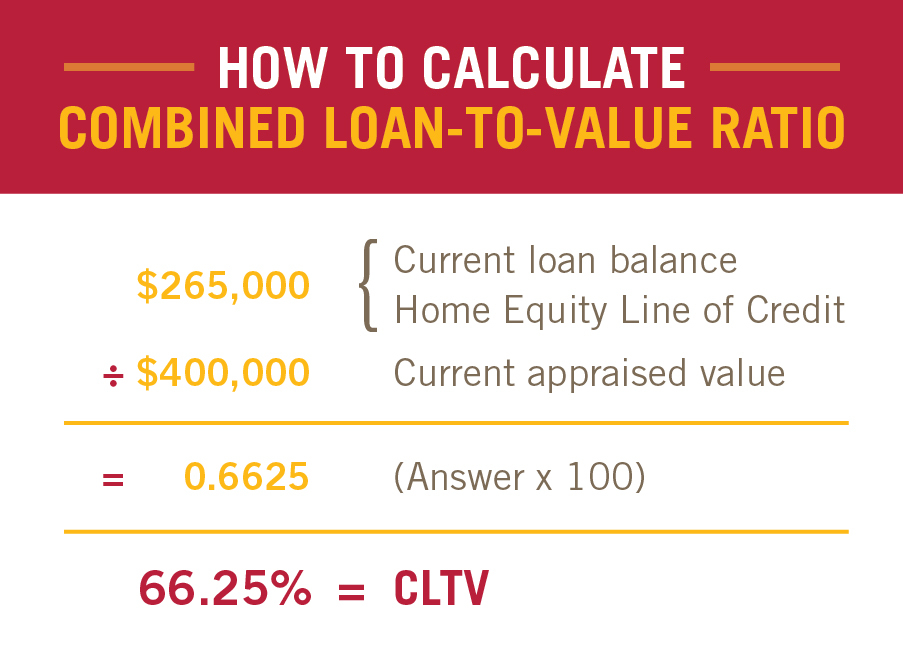

It can also display one additional line based on any value you wish to enter. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

APR is variable based on the Wall Street Journal Prime to and will not exceed 18. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. About us Press room Careers Advertise with us Site map.

Rate shown is based on collateral in second lien. Of course the final line of credit you receive will take into account any outstanding mortgages you might have. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

How to borrow. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Call us at 844-4TRUIST 844-487-8478 Monday through Friday 8 am.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Home equity line of credit HELOC calculator. A home equity line of credit is the most flexible type of home financing available.

This calculator is made available by one or more third party service. Free calculators for your every need. Obtaining the best rate also requires the following criteria to be met.

A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. The line of credit is based on a percentage of the value of your home. How A HELOC works.

At Bank of America we want to help you understand how you might put a HELOC to work for you. Put yours to work for youwith a home equity line of credit or HELOC. 1 There are no prepayment penalties or balance requirements plus a quick closing through Schwab Banks home equity lending program provided by Rocket.

As of Prime Rate is For Home Equity Loan. APR is variable based on the Wall Street Journal Prime to and will not exceed 18. Your actual Annual Percentage Rate APR may be higher than the rates shown.

A home equity line of credit or HELOC could help you achieve your life priorities. To 8 pm or Saturday 8 am. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and. 1 The rate is for illustrative and educational purposes only. As of APRs for Home Equity Loans range from to and will not exceed 18.

For Home Equity Line of Credit. Simply enter the amount you wish to borrow the length of your intended loan vehicle. Revolving credit line based.

Discuss your account and review your options.

Igggj8rtmah0cm

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Home Equity Loans Home Loans U S Bank

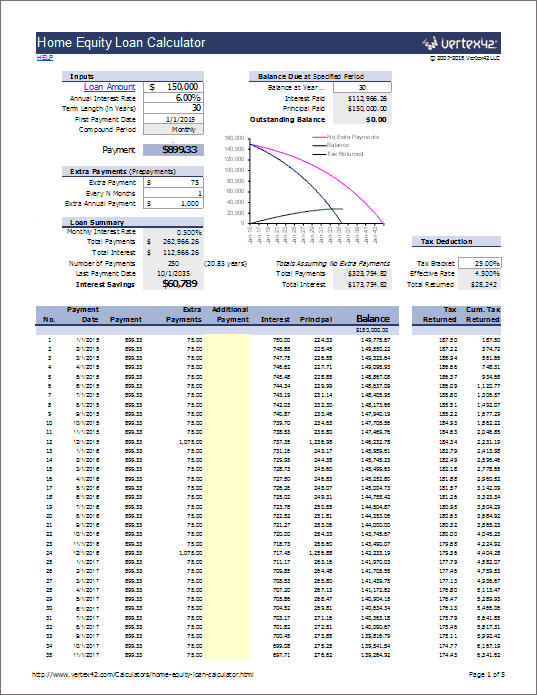

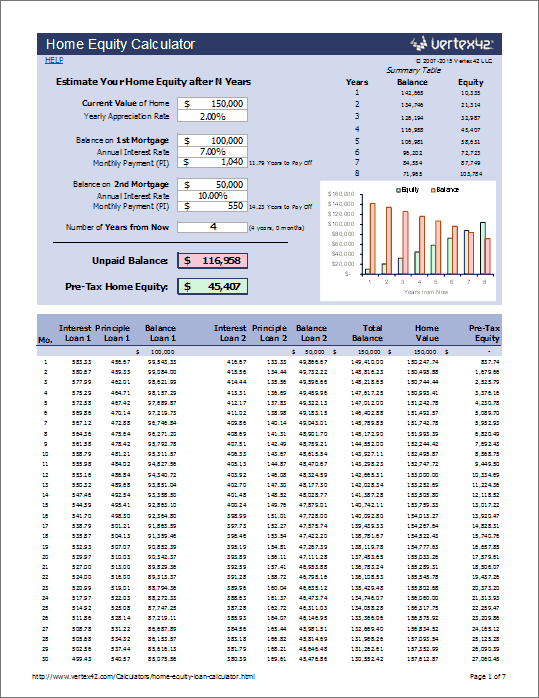

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Qualification Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What S The Difference Between A Home Equity Line Of Credit And A Home Equity Loan Investmentbanking Investment Home Equity Home Equity Loan Line Of Credit

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Amortization Schedule

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Use Home Equity Line Of Credit U S Bank

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loan Calculator Which Home Equity Loan Is Right For You

Mortgage Loan To Get Debt To Income Ratio Line Of Credit Home Equity

Home Equity Line Of Credit Heloc Home Loans U S Bank